The Affordable Care Act

Healthcare reform provides unique considerations for American Indian’s access to healthcare and wellness. The Affordable Care Act includes a number of provisions that protect American Indians and modernize the Indian Health Care delivery system and has had significant impacts on the Urban Indian community and Urban Indian Health Programs.

American Indian Protections

Under this legislation, American Indians have special protections and provisions within Covered California, California’s health insurance marketplace. CCUIH, in partnership with the California Rural Indian Health Board, developed and disseminated informational materials specific to American Indians for Covered CA.

These are available below.

Covered California for American Indians

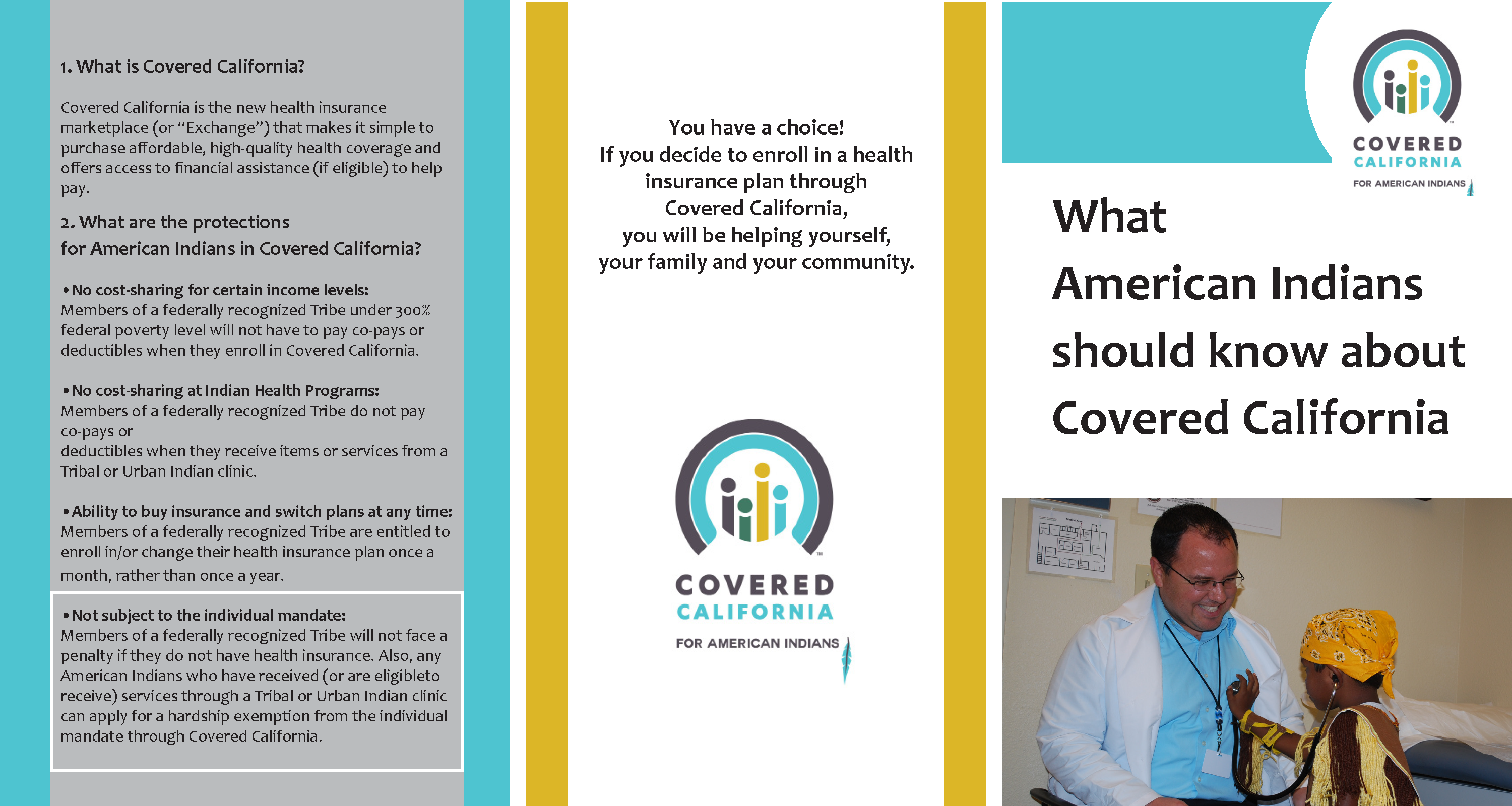

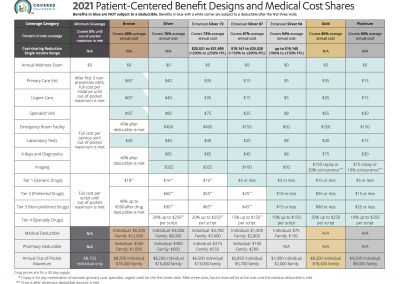

Covered California is the online “marketplace” that makes it simple to purchase affordable, high-quality health coverage and offers access to financial assistance (if eligible) to help pay. Through Covered California, eligible American Indians are able to enroll in health coverage and have access to unique benefits. American Indians’ eligibility for benefits varies depending on the type of coverage they are qualified for. These unique provisions include:

No Healthcare Expenses

for Certain Income Levels:

Members of a federally recognized tribe with a household income of less than $70,650 for a family of four (classified as 300% of the federal poverty level) will not have cost sharing (co-pays or deductible).

No Healthcare Costs for

Medical Care Provided by

Indian Health Programs:

There is no cost sharing (co-pay or deductible) for members of a federally recognized tribe, for any item or service received from an Indian Health Program including Tribes and Urban Indian Programs, regardless of household income.

Entitled to Monthly

Enrollment Periods:

Members of a federally recognized tribe are entitled to change plans once month through Covered California. All other taxpayers are subject to the annual open enrollment period.

Not Subject to the

State Mandate:

Members of federally recognized tribes and American Indians who have recieved or are eligible to receive services through and Indian Health Program qualify for an exemption from the tax penalty (often called the “shared responsibility payment).

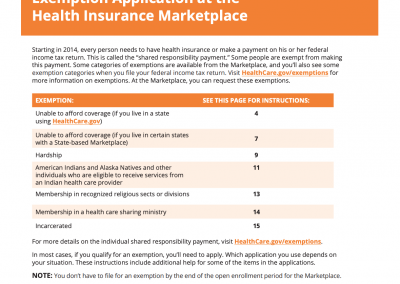

American Indian Exemption

from the State Mandate

Starting in 2021, individuals in California must have health coverage or pay a tax penalty, known as the “shared responsibility payment.” When the Affordable Care Act was implemented, this mandate existed on a federal level, and after the repeal of this provision, California adopted a statewide mandate to replace it. American Indians and Alaska Natives (AIAN) who are eligible for services at an Indian health facility qualify for an exemption to this tax penalty.

Qualified AIAN Individuals Are:

a) Members of federally recognized tribes (including Alaska Native shareholders)

AND/OR

b) Eligible to receive services from an Indian Health Service, Tribal, or Urban Indian Health Program

Additional Resources

CCUIH has partnered with The California Rural Indian Health Board (CRIHB) to develop useful materials to help American Indians in California understand these protections and provisions. Click on the images below to flip through the “Quick Guide” and informational booklet:

Qualified AIAN can claim an exemption from the shared responsibility payment through the tax filing process or the exemption application via the Health Insurance Marketplace.

Click here to access the Application for Exemption for American Indians and Alaska Natives

Click here to access Instructions to Help You Complete an Exemption Application

Click here to learn more about exemptions (Healthcare.gov)

Click here to learn more about the AIAN exemption